2024 Blockchain Predictions From Blockchain Coinvestors

2024 BLOCKCHAIN PREDICTIONS FROM BLOCKCHAIN COINVESTORS

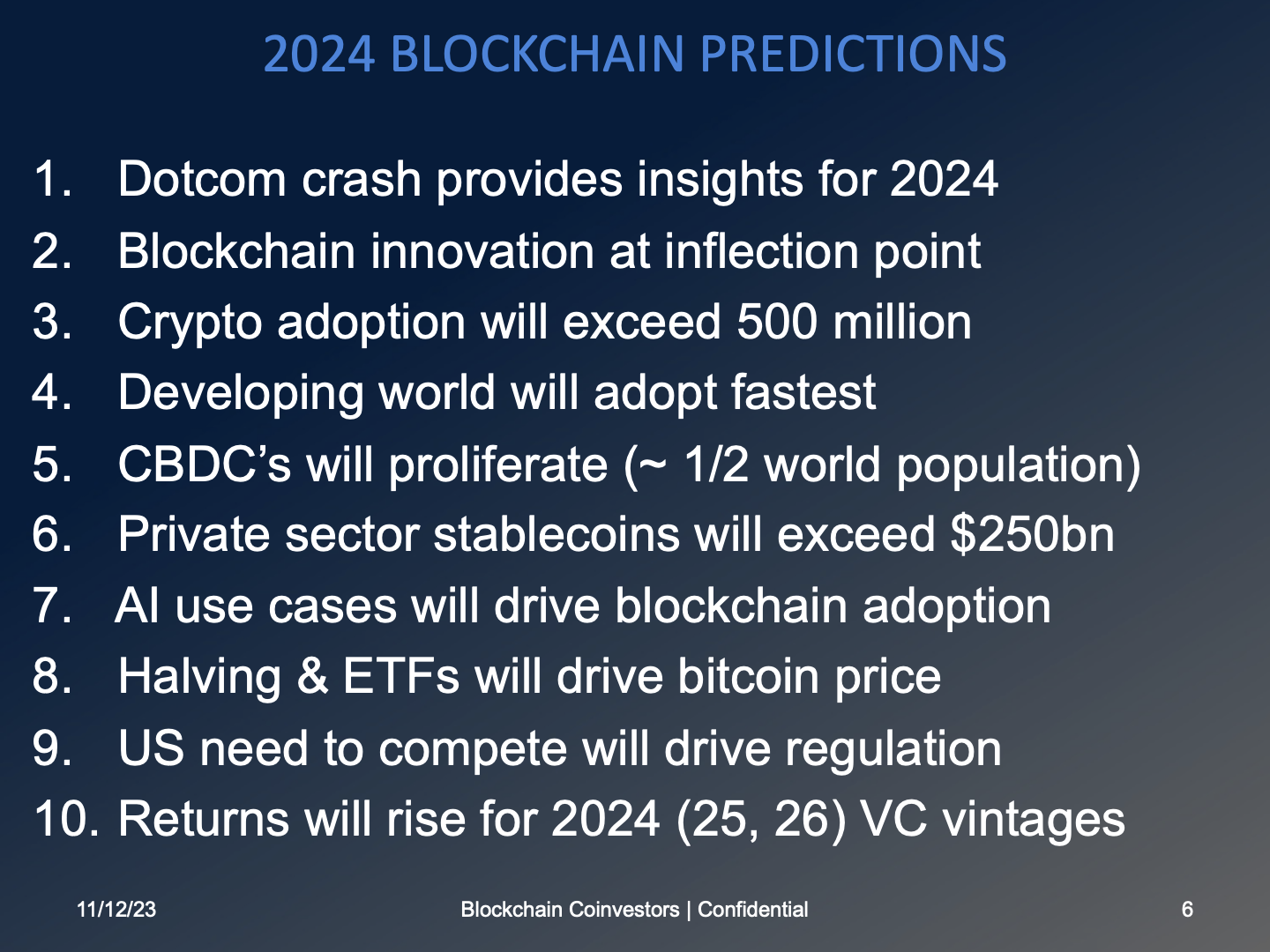

Every year in November we publish our predictions for the year ahead. Last year we were mostly on point. In this week's newsletter we provide a brief summary of each of the 10 predictions for blockchain in 2024.

In addition, we held our 2024 Blockchain Predictions webinar on November 14th. You can watch it by clicking here.

Prediction # 1: Dotcom Crash Provides Insights for 2024

We have seen this all before.

The world lived through the digitalization of communications and content as we deployed a new technology stack which we call 'The Internet'. The global transformation began in the 1980's, accelerated during the 1990's before reaching an apparent crescendo (bubble) in 2000. When it popped in 2001, prices fell, failure was everywhere, and the naysayers said 'we told you so'. More specifically, the newspapers were full of articles that the Internet had been a fraud, many lawmakers argued it should be banned or at minimum greatly constrained, and even famous investors like Charlie Munger (Warren Buffet's partner) argued "It will increase efficiency, but lots of things increase efficiency without increasing profits. It is way more likely to make American businesses less profitable than more profitable. This is perfectly obvious, but very little understood."

Of course, the dotcom crash did not stop Internet innovation. In fact, it was only just beginning and the 00's saw an acceleration of adoption, the rise of ever more powerful use cases, and the arrival of new players that became some of the most valuable companies in the world today in stark contrast to Munger's mistaken prediction. The investors that backed the next wave of Internet driven innovation from 2002 until today captured the highest returns.

Blockchain has just gone through its 'dotcom crash' moment in 2022 and 2023. Expect that in 2024 we will see an acceleration in adoption, the rise of ever more powerful use cases, and the arrival of new blockchain players that will become some of the most valuable companies in the world today.

Smart investors know what they should have done in 2002 and 2003. Remember, and make sure you do it this time around in 2024 and 2025.

Prediction # 2: Blockchain Innovation at Inflection Point

While today the media focuses on the prices of Bitcoin and other leading publicly traded liquid crypto assets, blockchain innovation is not driven by public market prices. It is driven by innovation powered by a generation of computer scientists and engineers who chose to embrace the technology stack and create new products and solutions upon it.

All of the underlying drivers of such innovation show we are at an inflection point. It takes time to write code, but a generation of the world's best ever software engineers have embraced blockchain technology and become conversant in it and - now supported by open source access and AI based software writing tools - they are accelerating the pace, breadth, and depth of blockchain software development.

Inflection points like this show up today in early stage startup activity and new product and service pilots and experiments, but don't become broadly visible for perhaps five more years in terms of globally adopted use cases. But we and the 45 plus blockchain venture funds that we have partnered with could not be more optimistic. Blockchain innovation is at an inflection point powered by a generation of the best engineers the world has ever known.

Prediction # 3: Crypto Adoption will Exceed 500 Million

Our investment thesis is that digital monies, commodities and assets are inevitable and that all of the world's financial infrastructure will need to be upgraded to support them. Cryptos are a subcategory of digitalized value, but we track them closely because they are a lead indicator of where we are heading.

We predict that in 2024 we will finish the year with more than 500 million active crypto supporters who use the decentralized forms of value. While a disproportionate share of them will be digital natives, we see this as still the 'early adopter' phase. As the crypto industry works to make the UI and UX more accessible, easier to use, and ready for the other 7.5 billion people, we expect the rest of us to follow - the late adopters and laggards.

This prediction might be greatly accelerated by breakthroughs in user experience, but even 500 million is a massive step forward for blockchain and the industry built upon it.

Prediction # 4: Developing World will Adopt Fastest

It is in the developing world where monies are most broken and user pain points most obvious. While it may be hard to appreciate the benefits of digital monies when you have sound money in your country, when you wake up every morning fearing hyperinflation, expropriation, and monetary collapse, you don't have any misperceptions. You want sound money today, and if your own government makes that hard, then you will find a way.

Gold and the US dollar have been widely accepted back up plans throughout the developing world, but neither is as well suited to address practical pain points as Bitcoin is. Gold can still be taken from you at the border, and your government can seize your US dollar based bank account. Bitcoin was designed to overcome these and other shortcomings.

Expect the fastest rates of adoption in bitcoin and other decentralized digital monies to be in the developing world in 2024.

Prediction # 5: CBDC's will Proliferate (~1/2 World Population)

The corollary of prediction #4 is that if you run a country in which your people are deserting your sovereign currency and embracing bitcoin and other decentralized money, then you have to move quickly to come up with an alternative. So it is not surprising that China moved so quickly to launch a CBDC (Central Bank Digital Currency), the digital Yuan.

In 2024, Brazil, India, Mexico, and other countries will do the same. We predict more than 15 CBDC's will be in rollout and at least 25 will be in pilot.

Most importantly of all, about half of the world's 8 billion people will be in the process of getting educated by their governments with regard to the consumer benefits of digital monies and wallets. This will in turn only further accelerate adoption of the world towards our investment thesis.

2024 will be the year in which 4 billion people are told digital monies are in their future.

Yes the US will be a laggard in this transformation, not least because of the confusion around the pros and cons of CBDCs. See the next prediction for the consequences of this US inaction.

Prediction # 6: Private Sector Stablecoins will Exceed $250 Billion

In the US, the failure of the central government to define the next wave of dollar innovation will spur a rapid wave of private sector innovation. We already have Circle and Tether which are providing global consumers real benefits as they seek to work in US dollars. In 2024, the leading financial private sector players will get in on the game with a raft of stablecoin announcements - PayPal already being in the lead in this regard.

At this point, the leaders of every large bank, payment company, asset manager and exchange can see that as Bank of America puts it "Stablecoins are the greatest invention in the history of money."

They will not want to be left out, and they already know Tether is far more profitable than their legacy ways of transacting. If the US government will not make digital dollars available worldwide, they will.

Prediction # 7: AI Use Cases will Drive Blockchain Adoption

The topic of AI is everywhere right now. It has been thirty or forty years of slow burn in which a lot of big data, algorithmic insights, machine learning and generative AI foundational work has been done. Now the arrival of OpenAI's ChatGPT has brought an easy to use UI/UX and is perhaps AI's 'iPod/iTunes' moment. Before the latter, it was possible to download and carry with you digital music, but it was so hard to do that almost no one did. After Apple gave us all an iPod and iTunes none of us has looked back and CD's and DVD's became a footnote in history.

All technologies and innovations are maybe double edged swords. They can be used for good purposes and for bad. In the case of AI we are excited by generative AI, the possibilities of decentralized and AI driven science, and the prospects for AI accelerated software development (multiplying the rate at which software eats the world by 10x, 100x, 1000x ?) as examples.

However, what is getting little media coverage right now is that the likely first and largest use cases of AI will be bad ones. Everything we have seen recently that threatens us and the integrity of the Internet and how we use it - like breaches, hacking, phishing, and scams of all sorts all the way to state sponsored cyberwarfare and terrorism - will now be AI enabled.

This means we need to solve the fundamental flaws of the Internet which make it unfit for purpose for the digitalization of monies, commodities and assets. Those include weak security, lack of systems of identity and trust, over concentration, and reliance upon legacy monies and assets with their single points of failure.

2024 will be the year in which AI driven, bad actor initiated, failures in the current global infrastructure make clear the need for Satoshi's invention. A method for complementing the Internet stack with a technology stack that brings higher order security, identity, trust, and so on.

That complementary technology stack is called distributed ledger technology or blockchain.

Prediction # 8: Halving & ETFs will Drive Bitcoin Price

We are early stage venture investors, and always tell you we don't actively trade in public liquid crypto such as Bitcoin or Ethereum, as we don't have ways to understand public market prices or how and why they change. So our 8th prediction takes us out on a limb because it is focused on the price of Bitcoin.

We expect 2024 to be the year in which Bitcoin reaches an all time high. Driven by the upcoming halving and by the launch of spot ETFs, it will become very easy for the RIA's of America who place and manage a huge proportion of US wealth - as well as the financial advisors of every other country in the world - to give their clients a small allocation in Bitcoin as their first entry into the crypto space.

These two forces, combined with the organic growth of wallets and Bitcoin users already referred to in prediction #3 and #4 above, will drive up Bitcoin price given its constrained supply written into Satoshi's monetary policy.

Prediction # 9: US Need to Compete will Drive Regulation

Our 9th prediction is that 2024 will be the year in which US lawmakers and regulators shift from trying to slow down blockchain, to instead trying to create pro-innovation regulation to accelerate the US's competitiveness in digital monies, commodities and assets.

The reason is that by the end of 2024 almost every other jurisdiction in the world will be firmly on a path to take the 7.7 billion people who are not US citizens into this new age in which commerce is digitalized and low cost, fast, and easy to access. Already Coinbase states that 80% of the G20 countries have passed at least one piece of pro-innovation digital money, commodity and asset legislation, and our own regulatory tracker shows similar dynamics.

The problem for the US is that you can't continue to be the global financial leader and world reserve currency if the largest countries in the world by population have all launched CBDCs and have required their citizens to begin to use digital wallets in their commercial affairs. The latter will have solved the issues of global remittances through interoperability bridges between their CBDCs such as by the M CBDC Bridge experiment of the BIS, Hong Kong Monetary Authority and China, Thailand, and UAE. When they succeed it will no longer be necessary to pass international trade through the US dollar.

So the US dollar, and the way it is globally transacted (SWIFT) will need a rapid technology upgrade. Which will in turn require a rapid 180 degree reversal in how the US regulators face off against blockchain. They were pro-innovation before with the Internet which is why the US won that global technology upgrade. They will need to be again to make sure the US maintains its worldwide competitiveness in the war of nations.

The private sector leaders of the US's largest financial institutions now get this. If the US is not competitive on digital monies, commodities and assets then they in turn will not be able to compete. Which is why they are now beginning to lobby Washington to get moving faster on pro-innovation legislation.

Prediction # 10: Returns will Rise For 2024 (25, 26) VC Vintages

Our final prediction for 2024 is one we have shared with you before. Superior returns in venture are highest in the years following the depths of a recession for very simple reasons. Foremost among them is that venture capitalists can invest in new startups at lower valuations than in the 'go go' years such as 2020 and 2021, or 2007 and 2008, or 1999 and 2000.

This is why private equity returns were highest for the vintages that followed the dotcom crash and the Great Financial Crisis.

We fully expect the vintages of 2024 (and 25 and 26) to be better than in recent years for this reason. Which makes it a very good time to be investing into newly formed venture investment vehicles.

Upcoming Closings

November always seems to be a rushed month and this year will be no exception since we will be preparing for closings on all 3 of our funds:

We will hold the first closing of Blockchain Coinvestors Fund VII (Fund of Funds) early in 2024. The fund will invest in 20+ blockchain venture capital funds, which will allow our investors to make a single investment and get global, diversified exposure to early stage blockchain investments backed by the world's leading investors.

Fund IV (Early Stage Token) will open for its quarterly subscription window in December. It continues to find compelling early stage opportunities leveraging the knowledge we receive regarding the investments of our 45 and growing blockchain venture fund partners.

Fund VI (Mid Stage Growth) is also accepting capital, and has just begun to invest into opportunities at greatly reduced valuations. Fund VI also leverages our asymmetric information and proprietary access resulting from our unique position within the blockchain investment ecosystem.

Downturns are good times for early stage investors, and returns are highest for the funds that invest in the early stage in the two and three years following the depth of a recession.

Please reach out to ir@blockchaincoinvestors.com if you would like to learn more.

Thank you for reading.

The Blockchain Coinvestors Partners