Bitcoin's Inflection Point: What It Means for Hong Kong Investors

Bitcoin's Inflection Point: What It Means for Hong Kong Investors

In our last article, we explored how the Trump administration's second-term economic agenda has elevated Bitcoin from a speculative asset to a potential strategic reserve, with initiatives such as banning CBDCs, encouraging crypto-friendly regulatory changes, and IMF’s recognition of Bitcoin as a legitimate foreign reserve asset. This raises an important question for retail investors and family offices: if governments are beginning to treat Bitcoin like digital gold, should investors view it as a safe haven asset, or does it still belong in the category of high-risk speculation?

In this follow-up, we unpack Bitcoin’s evolving role in the global financial system and what it means for everyday portfolio strategy—especially in a world where traditional financial assumptions are being rewritten by blockchain innovation.

Bitcoin at an Inflection Point: Risk Asset or Safe Haven

Since early 2025, following tariff-driven market shocks triggered by the Trump administration’s renewed protectionist policies, Bitcoin has surged past $96,000, a dramatic rise from its 2025 low. Meanwhile, U.S. equities have yet to recover from their sharp decline. This divergence marks a potential inflection point, suggesting that Bitcoin's role in portfolios may be fundamentally changing.

The following table summarizes the percentage increases. Bitcoin's 26.91% increase is significantly closer to gold's 23.48% than to the S&P 500's 12.47%. Pattern is more apparent in recent days (late April – early May).

Source: Daily trading data from Trading Economics, MarketWatch and CoinMarketCap; Blockchain Coinvestors analysis

To further evaluate Bitcoin's behavior, we analyze its price correlations with the S&P 500 and gold across four time frames: 2015-2020, 2021-2023, 2024-2025, and 2025 year-to-date (YTD). The correlation coefficient, ranging from -1 to 1, measures how closely two assets move together, with values closer to 1 indicating stronger positive correlation.

Bitcoin and S&P 500 Correlations

The correlation between Bitcoin and the S&P 500 has evolved over time, reflecting changes in market dynamics and investor perceptions.

Bitcoin vs. Equities

2015-2020: During this period, Bitcoin's correlation with the S&P 500 was low, approximately 0.35 (Bitcoin Correlation). Bitcoin was largely seen as an independent asset, with its price driven by crypto-specific factors rather than broader market trends.

2021-2023: The correlation increased to around 0.41, particularly during the COVID-19 pandemic when risk assets, including Bitcoin and equities, moved more in tandem due to global economic uncertainty.

2024-2025: The correlation rose further to approximately 0.64, reflecting Bitcoin's growing integration into mainstream financial markets and its sensitivity to macroeconomic factors.

2025 YTD: In the first five months of 2025, the correlation is estimated at 0.68, driven by shared responses to Trump's tariff policies and market volatility.

Bitcoin and Gold Correlations

Bitcoin's correlation with gold has also increased over time, supporting the notion that it is adopting safe haven characteristics.

Bitcoin vs. Gold

2015-2020: The correlation was low, around 0.21, as Bitcoin was primarily a speculative asset, while gold maintained its traditional safe haven role.

2021-2023: The correlation rose to approximately 0.52, with both assets showing similar responses to economic uncertainties, such as during the COVID-19 market downturn.

2024-2025: The correlation increased to around 0.59, indicating that Bitcoin and gold are increasingly moving in tandem, particularly during periods of geopolitical and economic stress.

2025 YTD: The correlation is high, around 0.74, as both assets have rallied significantly in response to tariff-related uncertainties.

The following table summarizes the estimated correlations:

Source: Daily trading data from Trading Economics, MarketWatch and CoinMarketCap; Blockchain Coinvestors analysis

Behaviour During Market Events

Bitcoin’s correlation with both the S&P 500 and gold has steadily increased over time, suggesting it’s influenced by both stock market trends and safe haven demand. Notably, during the 2020–2023 COVID period, its correlation with gold rose, reflecting a growing perception of Bitcoin as a store of value. This trend continued into 2025, particularly during the tariff-driven market turbulence. As the S&P 500 dropped below 5,000 on April 8, Bitcoin surged from $76,329.09 to over $96,000, while gold rose from $2,639.00 to $3,258.70—pushing their correlation to 0.74. This divergence from equities underscores Bitcoin’s evolving role as a hedge against economic uncertainty, increasingly mirroring gold’s safe haven behavior.

Exhibit 1: Historical performance of major asset classes

Source: Bitwise Asset Management with data from Bloomberg

Bitcoin is entering a new phase of maturity. With over 94% of its total supply already mined and only 225 BTC expected to be issued daily after the 2028 halving, the traditional 4-year cycle—once driven by supply shocks—is becoming less relevant. Moving forward, Bitcoin’s price is likely to be influenced more by macroeconomic forces such as global liquidity, institutional participation, and broader business cycles. This shift is reflected in Exhibit 1, which shows Bitcoin frequently swinging from the top-performing to the worst-performing asset year over year. As Bitcoin continues to mature, we expect these extreme swings to stabilize gradually.

Beyond Bitcoin: Exploring the Full Spectrum of Blockchain Investments

“Now that Bitcoin is increasingly behaving like a traditional asset class, what other investment categories should we be looking at — and where is the potential for alpha or value investing?”

This is a key question we often get from investors. And the answer is: there’s much more to blockchain than just Bitcoin.

There are six distinct asset classes within the blockchain ecosystem. This broader landscape includes both private and public opportunities, each offering different pathways for return, diversification, and strategic positioning. Bitcoin is a major example in Public Token category.

Exhibit 2: Blockchain Asset Classes

Source: Blockchain Coinvestors analysis

Early-Stage Venture Equity (Private Equity – Early)

Investing in blockchain-focused startups via traditional equity. These companies build essential infrastructure like exchanges, wallets, payment platforms, and blockchain-based apps. Investors aim for long-term value creation through M&A or IPOs.

Examples: Equity in startups building wallets, custodians, or blockchain SaaS platforms.

Mid/Late-Stage Venture Equity (Private Equity – Mid/Late)

Later-stage investments in companies with product-market fit and scaling revenue. These investments carry less early-stage risk and are closer to exit events like acquisitions or public listings.

Examples: Series B+ rounds in crypto exchanges, data providers, or enterprise blockchain platforms.

Public Blockchain Equities (Public Equity)

Listed equity in blockchain-related companies, such as public exchanges, crypto banks, and infrastructure providers. These offer liquid exposure to the space via traditional brokerage accounts.

Examples: Coinbase, Galaxy Digital, public mining firms, Bitcoin ETFs.

Early-Stage Token Investments (Private Tokens – Early)

Early access to tokens of blockchain protocols before they launch publicly. These are often negotiated deals with infrastructure projects, DeFi platforms, or decentralized applications.

Examples: Seed rounds for new Layer 1s, DeFi platforms, or decentralized AI protocols.

Private Token Sales & Secondary Markets (Private Tokens – Mid/Late)

Later-stage token deals, including structured private sales or secondary purchases. Typically closer to mainnet launches or major product milestones, often offering better pricing or liquidity terms.

Examples: Strategic private sales before token listings, or discounted purchases from early holders.

Public Liquid Tokens (Public Tokens)

Investing in tokens that are already trading on public markets. Strategies here range from long-term “liquid venture” investing to active trading or market-neutral approaches.

Examples: ETH, SOL, UNI, liquid staking tokens, and token-focused ETFs or funds.

This framework was developed to help investors think beyond Bitcoin and discover where alpha generation, long-term value, and diversification can come from across the blockchain economy. Each of these six categories offers unique advantages, risk/reward profiles, and liquidity characteristics. To build a resilient and well-balanced blockchain portfolio, one that can withstand market cycles and capture long-term upside, and no vertical can be overlooked. A truly diversified strategy requires thoughtful exposure across both early-stage innovation and liquid public markets, combining growth potential with defensiveness and flexibility.

Perspective from Hong Kong

Over the past year in Hong Kong, I’ve observed a clear shift in investor preference within the crypto space. There’s been a move away from early-stage venture capital toward hedge funds and secondary trading strategies. This trend is understandable. In a rising market, Hong Kong investors tend to favor liquid, short-term instruments that offer more immediate returns. Many Hong Kong family offices and individuals were also impacted by the last cycle’s NFT hype and failed projects, including scams and “rug pulls.” In addition, “Venture Investing” is a relative exotic term to Asian retail investors compared to US investors. After those experiences, it’s reasonable that investors are now leaning toward strategies that feel more controlled, transparent, and liquid.

But while this preference for liquidity makes sense in the near term, it’s important not to dismiss venture capital simply because it operates on a longer timeline. VC plays a foundational role in the digital asset ecosystem, and several of its characteristics are especially relevant in today’s environment.

First, venture is where early innovation begins. Many of the technologies and protocols that liquid strategies now trade originated from VC-backed teams. Second, venture is structurally less exposed to unsystematic risks like exchange failures or sudden platform collapses. In the 2022 cycle, it was primarily hedge funds and trading strategies, with assets on centralized exchanges or in lending protocols, that suffered losses from events like FTX and Genesis. Venture capital, by contrast, is typically deployed off-exchange, tied to project equity or early-stage tokens, and was largely insulated from these disruptions.

This reflects the different structural and risk profiles of the two approaches:

Blockchain Coinvestors analysis Structural risk profiles for Crypto Venture(VC) vs Crypto Liquid Strategies

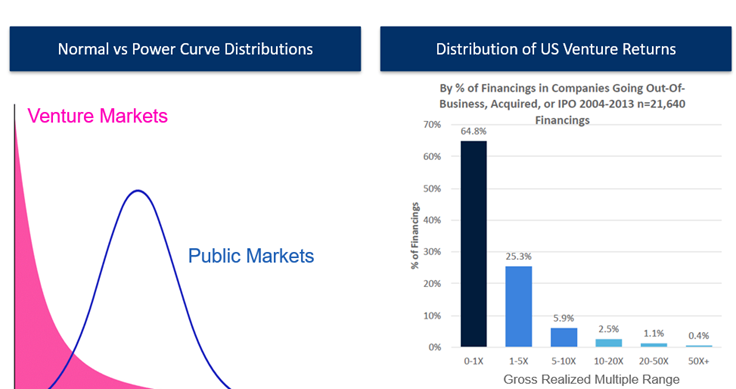

Third, venture investing follows a power law distribution — a concept that is often misunderstood. Most early-stage investments may underperform or fail, but a small number of standout companies tend to generate the majority of returns. Historically, fewer than 5% of venture deals deliver returns of 10 times or more, yet those few can define the entire portfolio. That’s why diversification and manager discipline matter.

Exhibit 3: VC’s power law return

Source: Correlation Ventures; Includes Data from Dow Jones and Other Sources

For Hong Kong investors, this moment may actually represent a strong entry point for venture. According to Galaxy’s 2024 report, crypto venture fundraising fell to 5.75 billion US dollars in 2023 — a sharp drop of 85% from the prior year. With valuations reset and speculative capital exiting the space, founders are once again building with focus. Historically, these quieter periods have often produced the most successful venture vintages.

At the same time, liquid strategies are still in recovery mode. A few quant and fundamental hedge funds performed well in late 2023, but only about 4% outpaced Bitcoin over the full year. Many funds are still below their high watermarks after the FTX collapse and continue to face fundraising challenges. While liquidity is appealing when markets are calm, recent events have shown how quickly it can dry up during periods of stress.

For investors in Hong Kong, the question is not whether to choose between venture capital and hedge funds, but how to balance them. Hedge funds provide short-term flexibility and responsiveness. Venture offers long-term exposure to innovation and structural growth. Both serve different purposes in building a well-rounded portfolio.

Conclusion

Bitcoin’s recent behavior signals a turning point, and this shift invites a broader question: how should digital assets fit into a modern portfolio?'

Our long-standing strategy emphasizes diversification and specialization.

While liquidity is appealing in the short term, some of the most durable returns in crypto have come from backing early innovation through venture capital. At the same time, hedge funds offer tactical responsiveness as markets shift.

Just as important as what you invest in is who you invest with. A great venture capitalist is unlikely to be a top-performing trader or quant strategist, and vice versa. The best outcomes come from partnering with fund managers who are deeply focused and highly skilled in their respective domains.

For more information, please reach out to our team at ir@BlockchainCoinvestors.com.

Thank you for reading,

Joy Cai

Hong Kong

About Blockchain Coinvestors

Blockchain Coinvestors invests in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 12th year and to date we have invested in a combined portfolio of 1,250 blockchain companies and projects including more than 110 blockchain unicorns. Visit us at www.BlockchainCoinvestors.com to learn more.

“We invest in blockchain businesses”