Blockchain In Asia - 3 Billion People Steaming Ahead

Blockchain In Asia - 3 Billion People Steaming Ahead

First, thank you to all of you who participated in BlockTalk 2024. The event was exclusively for investors focused not on the question 'what are blockchain & crypto?' but rather 'what are the investment strategies and best practices of the leading blockchain investors?'

Around 400 wealth advisors, family offices and individual investors registered and the feedback has only been positive. We were joined by leading blockchain venture capital GP's, CEO's of public and private blockchain companies including Archax, Bitwise, Coinbase, Securitize, Uphold and Yellowcard all of which are portfolio companies here at Blockchain Coinvestors, and by Bernie Moreno who is standing for Senate in Ohio, Greg Kidd who is standing for the house in Nevada, and Kristin Smith President of the Blockchain Association.

If you were unable to make it:

Selected videos will be posted shortly.

It is not too late to complete the interest sheet - accredited investors for investment purposes only please.

Now on to the subject of today's newsletter.

HONG KONG WEB 3 FESTIVAL 2024

While BlockTalk 2024 was focused on investors, those events that cater to the broader blockchain and crypto ecosystems tend to be much larger. In the case of the Hong Kong Web 3 Festival going on this week, they don't come much bigger.

By the numbers:

50,000 registered attendees

300 speakers (including Matthew who keynoted on day 1)

100 exhibitors

200 side events

Hosted by Wanxiang group including Hashkey Capital which is one of our anchor venture capital partners

What are they talking about here in Hong Kong, and what is the sentiment on this side of the Pacific? Read on to learn the following eight big themes that are keeping everyone excited and motivated:

Chinese government is focused on blockchain

Hong Kong will be a global digital finance and crypto hub

Chinese crypto transaction levels are surging

Investors are back and seeking access

US Bitcoin ETFs are viewed with envy

Hong Kong ETFs expected soon including for Ethereum

Big institutions are partnering and not afraid to say so

Meme coin launches are everywhere - with some cautionary concern

Each is discussed in turn.

CHINESE GOVERNMENT IS FOCUSED ON BLOCKCHAIN

The keynote speakers here at Web 3 Festival were a who's who of blockchain, but perhaps the most keenly listened to were government officials from both China PRC and the Hong Kong China local government entities. The message was clear. The Chinese government is focused on blockchain, and expects rapid deployment:

China has a plan to advance the adoption and growth of web3 services within the nation.

The Ministry of Industry and Information Technology (MIIT) announced a framework including 'Focus on key areas such as government affairs and industry, encourage the development of new business models such as NFT and distributed applications (DApp), and accelerate the innovative application of Web3.0 and the construction of a digital ecosystem.'

Government officials emphasized that the China web3 development strategy includes four key areas to bolster China’s strategy for web3 development:

Conducting research tailored to the country’s specific conditions, mapping out the developmental trajectory and addressing matters related to innovation and legacy.

Improving the country's technical research and oversight.

Fostering collaborations with international industry stakeholders.

Enhancing the visibility of the technology.

Meanwhile, China is also piloting a new digital identity service called RealDID. 'This service aims to meet the demands of a burgeoning digital economy by striking a balance between ensuring user anonymity and requiring real-name verification.'

Cathy Woods of ArkInvest also keynoted day one, and in her comments she emphasized that Chinese legislation and regulation are impressive, pro innovation, and moving much more rapidly than under the US Biden administration which she viewed as of great concern for US national competitiveness.

HONG KONG WILL BE A GLOBAL DIGITAL FINANCE & CRYPTO HUB

While Hong Kong is part of China, it has its own lawmaking and regulatory bodies, and it was equally impressive to hear them present on the first day here. Some highlights:

The Hong Kong Securities and Futures Commission (SFC) stated they intend to quickly have a robust framework for crypto trading under institutional supervision.

They emphasized the need for clear guidelines that would allow Hong Kong to be a leading global digital finance and crypto hub, which is their goal.

The most senior government official present emphasized Hong Kong was open for the industry and intended to be a welcoming hub for crypto-related businesses and innovators.

Locals told me this was important information following directly after the China PRC comments. It demonstrated a level of coordination which is important for the industry to see and hear.

CHINESE CRYPTO TRANSACTION LEVELS ARE SURGING

One of the things that is hard to understand for a Westerner visiting China is the on the ground reality is not always the same as we are told in the Western press including CNN, FOX, the Wall St Journal and Economist to name but four. Recent perspective in all four of these would have you believe that China still bans crypto and this means that Chinese are not active in crypto.

Far from it. Yes there is still a Chinese crypto ban on the books, but in practice, both PRC and Hong Kong officials seem to be turning a blind eye if the exchanges are well run and 'coming in and talking to us' as one official told me (the humor here was intended I think, since Gary Gensler uses those same words too, but for a very different objective).

On the ground it appears:

Mainland Chinese citizens are given a $50,000 a year foreign exchange purchase quota and many are using it to move money to Hong Kong based cryptocurrency accounts.

As a result, the Chinese crypto transaction levels have experienced a surge in activity, with its global ranking in peer-to-peer trade volume skyrocketing.

In mainland China transactions are also growing fast.

One presenter shared 'the proportion of large retail transactions ranging from $10,000 to $1 million in China is nearly twice the global average of 3.6%.'

While only examples of the broader topic of blockchain transaction levels surging, these indicators are from the most regulated part of the marketplace, resulting from investor movements of capital. Meanwhile, the distributed, decentralized transaction levels are growing even faster.

While not Asian specifically, I was impressed to hear in Hong Kong that Coinbase's new Base platform just passed 3 million transactions in a single day.

Back to Asia.

INVESTORS ARE BACK & SEEKING ACCESS

We are also holding a large number of investor meetings in Hong Kong during the festival, and here too there is good news. Asian investors are back in force and wanting to invest into blockchain and crypto including in the early stage where we focus.

Just as one graphical example of this, our hosts HashKey Group, the digital assets and blockchain arm of Chinese conglomerate Wanxiang Group, announced they have received $360 million in commitments from investors for their new blockchain fund. We are pleased to be a part of that fund and impressed by the early investments we now have capital exposure to.

For those of you who are similarly looking to deploy capital, please ask for details of our new Fund VII by emailing ir@blockchaincoinvestors.com.

US BITCOIN ETFs ARE VIEWED WITH ENVY

The discussion is not just about Asia of course. Blockchain is a global industry, and the presenters in Hong Kong are keenly aware of developments around the world. In that context, the new US Bitcoin ETFs are on everyone's mind.

One presenter made the point very clearly when she said "Investors in BlackRock's IBIT Bitcoin Spot ETF bought more Bitcoin every single week since the ETF launched than the entire Bitcoin industry mined."

Rather than repeat what we have already written about this topic, please read newsletter vol. 6, No. 3 to see why Asia (and every other part of the world) is so impressed by these ETF launches.

HONG KONG ETFs EXPECTED SOON - INCLUDING FOR ETHEREUM

As a global financial center, Hong Kong is very good at moving fast when financial innovations appear. Hong Kong exchange officials said they are now accepting spot Bitcoin ETF applications:

The timing seems to be that new Hong Kong crypto ETFs may be approved as early as June.

HashKey expects their submissions for both Bitcoin and Ethereum spot ETFs to be among the first to launch.

These products explicitly assume that both digital products are commodities and not securities.

This also means they could be available for global retail investment subject to local jurisdictional rules.

This was a major discussion and there is, ironically, some jubilation that if the SEC does not move fast, Hong Kong will be the first to approve Ethereum Spot ETFs. The London Stock Exchange has already approved Bitcoin and Ethereum ETN products but as securities offered only to institutional investors.

BIG INSTITUTIONS ARE PARTNERING AND NOT AFRAID TO SAY SO

In our Institutional Digital Finance Adoption Report, we let you know about the high adoption rate of digital wallets and crypto custody in Asia. Here in Hong Kong, we were able to confirm there is great institutional interest and support for digital monies, commodities and assets, and unlike in the US, these same banks, asset managers and payment companies are explicitly saying so including on the convention floor.

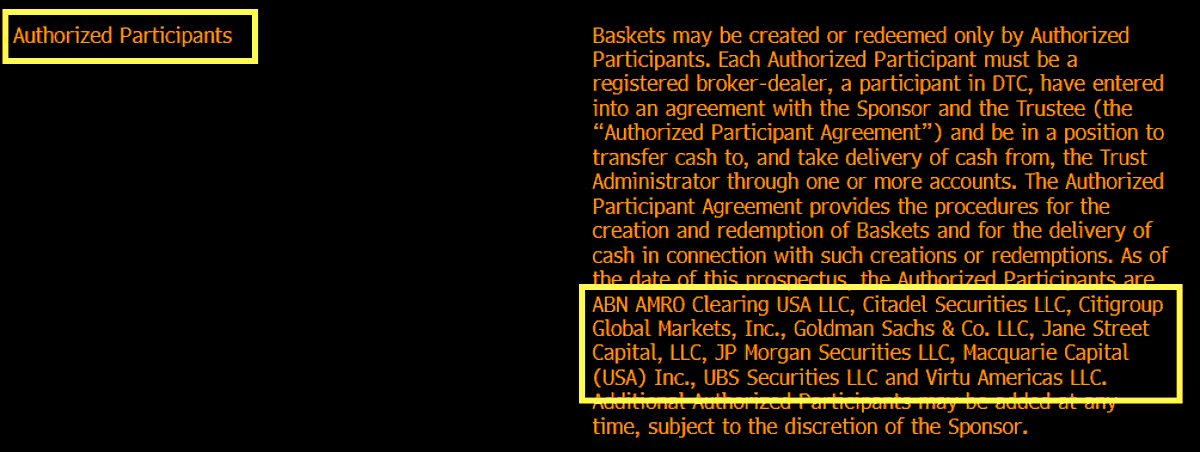

We can't speak to why the US institutions feel afraid to say they support the blockchain and crypto industry when by their actions they certainly do. Just as one example, Goldman Sachs just posted a very negative perspective on Bitcoin while at the same time scrambling to become an authorized participant to support BlackRock's Bitcoin Spot ETF.

Take a look at the updated BlackRock IBIT ETF prospective which includes now a host of US institutions some of which are among the most visibly hostile talkers.

We prefer to track what they are doing to what they are saying but find it disappointing they can't be more like the Asian traditional financial institutions - aligning what they say with what they do.

MEME COIN LAUNCHES ARE EVERYWHERE - WITH SOME CAUTIONARY CONCERN

Finally, among the eight themes of this newsletter must be Meme Coins.

One presenter offered the following definition, 'Meme coins are crypto tokens with no value, just launched for the crypto community to play with and if they wish, speculate with'.

Take it as you wish, but some of these tokens already have market capitalization values in the USD billions. How can that be if they don't have any value?

Well you many have heard us repeat what Van Horne taught us at Stanford GSB, but here we go again:

Conventional market theory begins with the proposition that markets are efficient

If markets are efficient, we can assume that the marginal most recent price is equivalent to the market clearing price (since markets are efficient, the most recent buyer would see the same value in an asset as any other buyer, and so all units of that asset could be sold at that price)

This allows us to take the marginal most recent price and multiply it by the stock of that asset, and this gives us the market capitalization

Of course, Meme coins are not efficient markets (are any markets truly efficient? Warren Buffet does not think so):

If a market is not efficient, then the most recent price could be anything.

I could give you $1 for 1 billionth of your iPhone just because I am your friend, but that does not mean that your iPhone is now worth $1 billion.

You can't multiply my price with the units because there is no deep and liquid efficient market which would agree with my offer to you.

Meme coins are launched by friends working together.

So maybe don't assume their market capitalization has anything to do with their most recent price action.

Caveat emptor if you apply your efficient market theory to Meme tokens. You may live to find you were not in the friend group after all.

The cautionary note being discussed here in Hong Kong, is that while everyone is issuing Meme coins to quickly capture those billion dollar valuations, we saw this before during the ICO and then the NFT crazes.

The fear is that we may see it happen once again.

Unwitting small investors being harvested by schemes in which the promoter takes advantage of this misunderstanding that efficient market theory just can't be applied to inefficient market assets - such as most Meme coins.

We do hope we are not seeing the early days of another blockchain nosebleed when so much of real substance is being built, launched and adopted globally.

So that is the view from Hong Kong on day three of Web 3 Festival 2024. It has been a very illuminating event so far.

As a closing note, please contact any of our team at ir@BlockchainCoinvestors.com to express your interest and receive the fund details.

Thank you for reading.

The Blockchain Coinvestors Partners.

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1000+ blockchain companies and projects including 80+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”